Move Your Money

Out of Rogue Casinos

We help you find the best online casinos licensed in the UK. Use our selection to pick a secure and trustworthy place to gamble online.

Casino Online UK 🥇 Best Casinos to Play for Real Money

US Players not Accepted

- EXTREMELY fast withdrawals

- Home to Leading Software Providers

- Fully Licensed & Regulated

US Players not Accepted

- EXTREMELY fast withdrawals

- Home to Leading Software Providers

- Fully Licensed

US Players not Accepted

- Quick and easy payouts

- Home to Leading Software Providers

- Generous Free Spins Bonus

Get up to £200 Bonus and 100 Spins

- Lighting Fast Payouts

- Generous Welcome Bonus

- Mobile-friendly site

US Players not Accepted

- Quick and easy payouts

- Home to Leading Software Providers

- Generous Free Spins Bonus

Welcome bonus up to £100 + 50 Bonus spins

- Top Gaming Providers

- Unique Loyalty Scheme

- Fully Licensed & Regulated

US Players not Accepted

- EXTREMELY fast withdrawals

- Home to Leading Software Providers

- Trustworthy payment services

80 Wager-Free Spins on 1st deposit

- Mobile-friendly site

- Generous Reload Bonuses

- Large Number of Games Available

At MoveYourMoney.org.uk we review and suggest the best casino sites for players

Best Casino Bonuses UK

PEACHY GAMES CASINO has a huge choice of slots and games to enjoy, and as you play you’ll earn peachy points. You can use the points to get free spins or other rewards from the loyalty shop. An amazing welcome offer is waiting for all new players. Open your account today to grab it!

- Great slots collection

- Exellent support

- Loyalty program

18+ New Players.100% bonus on first deposit up to £50 & 20 bonus spins credited immediately for Book of Dead only.Min dep £20.Max bet £5.Max cash-out £250.40x wagering.Bonus expiry 30days.Spins expiry 2days.Game restrictions.T&C Apply.

GRIFFON CASINO brings you hundreds of different slot games, loads of live dealer games, plus huge jackpots. A generous welcome spins package is granted to all new players. Up to 200 spins on some of the best slot games are given upon your first three deposits. Get them now!

- Variety of games

- Leading providers

- Generous welcome offer

18+ New Players.Require 3 deposits of min. £20.Spins issued as follows: 50 on 1st dep, 50 on 2nd dep and 100 on 3rd dep on selected games.Wager 35x winnings from free spins.Spins valid 24 h.Bonus valid 21 days.T&Cs apply.

SPINSHAKE CASINO gives you the chance to enjoy playing slot machines and other popular casino games. You can play all your favourite games such as Blackjack, Roulette, Poker and many more. Take advantage of the exclusive club VIP rewards program, which includes great special prizes. Sign up now!

- Live games available

- Good game collection

- Many payment methods

18+ New players.Min dep £20.40x wagering to match up bonus.Offer valid 24hrs.25 spins on Starburst.40x wagering to spins.T&Cs Apply.

KARAMBA CASINO is an online casino that allows players to start their gaming experience with fun and excitement. The casino offers many promotions and bonuses that increase your chances of winning. Its game collection offers hundreds of games in all slots categories and dozens of live games.

- Lucrative bonuses

- Professional support

- Variety of games

18+ New players.Min deposit £10.Max bonus £50.WR 35x.Spins valid 24hrs.100 spins require 3 deposit.Min 2nd and 3rd deposit £20.T&C Apply.

CASUSHI is a unique online casino inspired by Japanese culture. It has a high-quality game collection from some of the world’s most popular software developers. Fast withdrawals, professional customer service and lucrative bonuses are sure to keep you entertained.

- Enormous game library

- Unique design

- Professional support

18+ New Players.100% bonus on first deposit up to £50 & 50 bonus spins(1st day-30,2nd,3rd-10) for Book of Dead only.Min dep £20.Max bet £5.Max cash-out £250.40x wagering.Bonus expiry 30days.Spins expiry 2days.Game restrictions.T&C Apply.

FRUITKINGS CASINO is a casino site offering players the chance to access a vast array of slot games. The website can be accessed on desktop or via a mobile device and features a whole range of bonus offers. 100 free spins and up to £50 are available for first time depositors.

- Loyalty program

- Great support

- Slots variety

18+ New Players.100% bonus on first deposit up to £50 & 100 bonus spins(1st day-50,2nd,3rd-25) for Book of Dead only.Min dep £20.Max bet £5.Max cash-out £250.40x wagering.Bonus expiry 30days.Spins expiry 2days.Game restrictions.T&C Apply.

LUCKLAND CASINO offers one of the best casino game collections on the market. With a variety of classic casino games like roulette, blackjack and baccarat, it will be possible to make your gambling experience unforgettable. Make a deposit and get up to £50 and 50 bonus spins!

- Variety of live games

- Professional support

- Lucrative promotions

New players only 18+. Min deposit £20. 40x wagering applies to match up bonus . Offer valid for 1 week. 50 Spins on Starburst. 40x wagering applies to Spins. T&C Apply.

Recently listed online casinos

What games can you play at the top UK casinos

Video Slots

Online Slots come in many variants, such as video slots, classic slots, jackpot slots, etc. When selecting the best UK slots, look for high RTP (Return to player) percentages, and more pay lines. Basically the more the pay lines the higher the chance of winning.

Roulette

Players looking for simplicity have always liked roulette games. This trend passed along to online casino and now there is a wide range of roulette games available. Some of the best UK casinos will have Live dealer Roulette with a juicy welcome bonus for new players.

Blackjack

Blackjack is one of the most popular games, enjoyed by huge numbers of people every day in UK online casinos. It has many variants such as European Blackjack and Single Deck Blackjack. Most online casinos will offer a rewarding blackjack bonus when you register.

How to gamble online

Nowadays, all types of casino games are available online. The process of gambling online is easier than ever. In this guide we will show you how to play casino games for real:

2 Sign-up for a new player account

3 Make a minimum deposit

4 Get Promotions

5 Play Games

6 Withdraw winnings

We have explained in details each of the steps below. Follow our simple guide to start playing casino games at the best casino sites in the UK.

STEP1 – Choose a Safe Online Casino

Before you start it is important to make sure the casino you select is safe and secure. All casino sites listed on MoveYourMoney.org.uk are UKGC licensed and meet the highest standards of security.

There is no shortage of great games too. The top UK casinos have huge game lobbies with more than 1000 slot games as well as live dealer games such as roulette, blackjack, live shows and more.

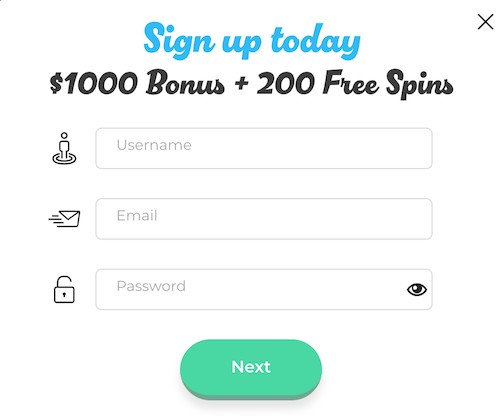

STEP2 – Sign up

The sign up process is quick and easy. To start your registration, select any game from the casino site and click the button “PLAY”. A registration form will open. First, you need to fill out the form, it may ask you for name, date of birth and phone number. Make sure to fill it accurately if you want to have a smooth withdrawal process later.

You will be asked to:

- Opt-in for the welcome bonus – You will be asked to opt-in for the welcome package. Before you opt-in you can check out the main bonus terms next to the casino offer. Usually that’s the small print near the bonus banner.

- Read & Accept Terms – To help you out we have simplified bonus terms and presented them in each casino review. You can also use our wagering calculator to calculate the sum you need to wager to release the bonus.

- Verify your account – You may be required to verify your account via email or SMS message. Simply follow the instructions.Submit the form – Finally, select a unique username and password and you are ready to click on the SUBMIT button. Now that you have a brand new account, it’s time to deposit.

STEP3 – Deposit

Each casino site has own list of accepted deposit methods:

– Online bank transfer

– Debit card (Visa and Mastercard)

– Paypal

– Trustly

– Pay by Phone (Boku)

Look at the bottom of the casino’s homepage to locate the logos of accepted deposit methods. Choose the most convenient for you but keep in mind:

- Deposit and withdrawal fees

- Bonus limitations

- Can you use the method both for deposit and withdrawal

- Deposit and withdrawal limits

In our casino reviews we show each casino’s deposit and withdrawal methods. Alternatively, you can access the banking page of the casino site and locate all the information you need there.

Depositing real money is simple:

1. Go to the deposit page in your player account

2. Select the payment method

3. Add your deposit sum

4. Opt-in for the bonus package (optional)

5. Click on the deposit button

After you have completed the process above the money should appear in your account. This may take as low as few seconds.

If you don’t see the money added to your balance, try to refresh the page. If no results, contact the customer support.

STEP4: Play Games

Now that your account is funded it’s time for the fun part! The best online casinos in the UK have vast game lobbies. You can choose from the following games:

– Online Slots

– Card games – Blackjack, Baccarat

– Dice Games – Craps, Sic Bo

– Live Dealer Games

– Scratch Cards

In addition to the traditional casino games, the sites can offer sports betting, poker and bingo. Virtually any form of online gambling is available on the UK market.

To select a game navigate to the game lobby. You will see all different game types as tabs. Simply select your favorite game type and click on the desired game in that category.

Before you start make sure you read the game rules. Then place the minimum bet and hit the SPIN or BET button in the game.

Most online casinos allow you to try the game for free. Select that option to avoid risking real money at first.

STEP5: Get Promotions

The longer you play at the casino site, the more bonus offers will be available in your player account. Some casinos have VIP packages aimed to entertain the most loyal players.

As a regular player you can get:

- Reload bonuses – Make your 2nd, 3rd and 4th deposit to get a deposit match from 25%-50% + some extra spins

- Weekly free spins – Some of the best casino sites offer 10, 20 or even 50 free spins on selected days of the week

- Slot tournaments – Take part in the tournament and you can win big prizes up to a few million pounds!

- Loyalty rewards – Most casinos reward you with points or chips for playing games. You can then exchange the points for free spins.

- Cashback – Some casinos will offer you a lifetime cashback of 10% on all your losses

Locate the promotions tab in your player account to see what offers are available in your player account.

STEP6: Withdraw winnings

You have to use the same method for both deposit and withdrawals. To withdraw your winnings go to the withdraw section in your player account and follow the steps:

1. Enter the amount you want to withdraw

2. Submit the request

3. Receive a confirmation via email or SMS

Most withdrawals should take between few hours and few days. That depends both on the payment method and the particular casino site. You’ll find the quickest online casinos on our Fast withdrawal casinos guide.

Why Gamble Online

Online casinos have several advantages compared to land-based casinos:

– Available 24/7 on smartphone or computer

– Lower minimum bets

– Bonuses and Promotions available

– More games

Ready to Play for Real Money?